How to Start an LLC in Illinois

If you’re an entrepreneur, selecting an entity type for your company is one of the most important decisions you will make. For many small business owners, a limited liability company (“LLC”) is the ideal business structure due to the flexibility, tax advantages, and liability protection it can offer. However, there are certain legal and procedural requirements that must be met under Illinois law if you are considering forming an LLC.

Here are the steps that must be taken to start an LLC in Illinois:

Select a Name for Your LLC

The first thing you must do to start an LLC is to choose a name. Importantly, the name you select must be different from those that are already on file with the Illinois Secretary of State. You can determine whether the name you are considering is already taken by searching the Secretary of State Business Services database. In the event you aren’t ready to register your LLC yet, you can hold a business name for up to 90 days by filing an Application to Reserve a Name.

To comply with Illinois law, an LLC name must contain the words “limited liability company,” “L.L.C.,” or “LLC.” But it’s important to understand that you do not need to use the LLC’s official legal name when conducting business. You may drop the “LLC” and use an assumed business name — also referred to as a trade name — by filing a “DBA” (doing business as).

Appoint a Registered Agent

If you are starting a business, it’s crucial to select an entity type that meets your objectives. At Litico Law Group, our business attorneys are dedicated to serving the needs of business owners in Illinois for a broad scope of legal matters, including LLC formation.

Every LLC in Illinois must designate a registered agent for service of process. Any individual who is at least 18 years old and an Illinois resident can serve as a registered agent. A company can act as a registered agent if it is authorized to conduct business in Illinois and maintains an office address there.

Prepare and File Articles of Organization

To register an LLC in Illinois, you must file Articles of Organization with the Illinois Secretary of State Department of Business Services. This document must set forth a variety of information regarding the LLC including the LLC’s name, the address of the LLC’s principal place of business, the date the Articles take effect, and the LLC’s purpose. It must also include a statement regarding the LLC’s duration and whether it will be member-managed or manager-managed.

Prepare an LLC Operating Agreement

Although an LLC operating agreement isn’t a legal requirement in Illinois or filed with the state, the document can establish the foundation of the LLC and specify how it will be run. An operating agreement outlines financial decisions, the rights of its members, and the responsibilities of its managers. If there are any conflicts concerning finances or the roles that each member will play, the operating agreement can address how these issues should be resolved in advance.

Obtain an EIN and Open a Business Bank Account

An IRS Employer Identification Number (EIN) must be obtained if an LLC has more than one member — regardless of whether it has employees. If you are the sole member of your LLC and do not have employees, you are exempt from this requirement. However, a single-member LLC must secure an EIN if it elects to be taxed as a corporation rather than a sole proprietorship. An EIN can be obtained through the official IRS website.

Once you have your EIN number, you should open a business bank account. This can help to ensure that your personal and business funds remain separate — and you sustain liability protection.

Comply With the Ongoing Requirements

Once you have set up an LLC, you must comply with the ongoing requirements. This means filing an annual report with the Secretary of State each year the LLC is in existence. The report is due before the first day of the LLC’s anniversary date every year. If you fail to file the annual report, the LLC will be dissolved and lose its limited liability protection.

To bring a company back into good standing after it has been dissolved, you must file for reinstatement with the Secretary of State. In addition, you must file an annual report and pay any accrued penalties, interest, and franchise tax due for each year the company did not file an annual report.

Contact an Experienced Illinois Business Attorney

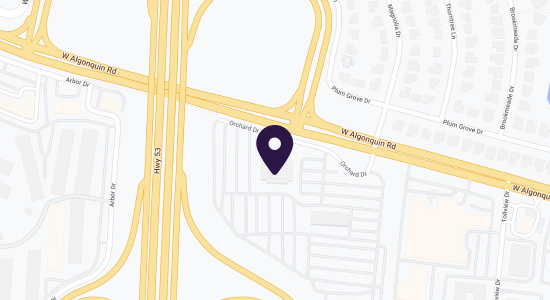

If you are starting a business, it’s crucial to select an entity type that meets your objectives. At Litico Law Group, our knowledgeable business law attorneys are dedicated to serving the needs of business owners in Illinois for a broad scope of legal matters, including LLC formation. We welcome you to contact us by filling out our online form or calling (847) 307-5942 to schedule a consultation to learn how we can assist you.